March 24, 2014

9:30 am – 4:30 pm

Location: Capital Conference Center

201 North Illinois Street, Suite 200

Indianapolis, IN 46204

This is a basic to intermediate level seminar. It is designed for attorneys, estate and financial planners, trust officers, accounting and tax professionals, and paralegals.

Course Contents:

1. Elder Law vs. Estate: Learn how the same techniques are applied differently

2. Estate Planning for Single Parents

3. Gun Trusts: Learn how they are used and review a sample

4. Planning for Same Sex Couples: Assist gay couples with the new laws for retirement and estate planning

5. Stretch IRA Trusts: Make use of the “stretch” feature of IRAs in estate plans

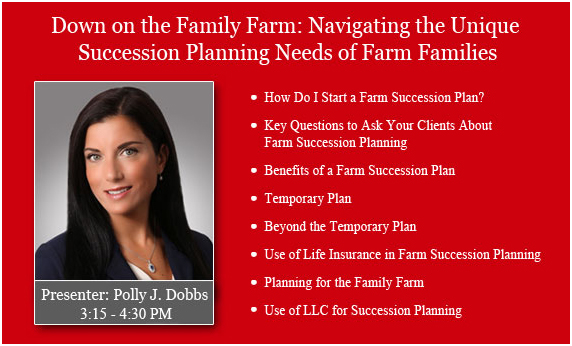

6. Down on the Family Farm: Explore business succession techniques that match farmers’ estate plans

Continuing Education Credit:

Continuing Legal Education – CLE: 6.00

National Association of State Boards of Accountancy – CPE for Accountants: 7.00

Financial Planners: 7.00

International Association for Continuing Education Training – IACET: 0.60

Institute of Certified Bankers – ICB: 7.50

For more information go here.